The secret sauce of Coles’ and Woolworths’ profits: high-tech surveillance and control

Coles and Woolworths, the supermarket chains that together control almost two-thirds of the Australian grocery market, are facing unprecedented scrutiny.

One recent inquiry, commissioned by the Australian Council of Trade Unions and led by former Australian Consumer and Competition Commission chair Allan Fels, found the pair engaged in unfair pricing practices; an ongoing Senate inquiry into food prices is looking at how these practices are linked to inflation; and the ACCC has just begun a government-directed inquiry into potentially anti-competitive behaviour in Australia’s supermarkets.

Read more: 8 ways Woolworths and Coles squeeze their suppliers and their customers

Earlier this week, the two companies also came under the gaze of the ABC current affairs program Four Corners. Their respective chief executives each gave somewhat prickly interviews, and Woolworths chief Brad Banducci announced his retirement two days after the program aired.

A focus on the power of the supermarket duopoly is long overdue. However, one aspect of how Coles and Woolworths exercise their power has received relatively little attention: a growing high-tech infrastructure of surveillance and control that pervades retail stores, warehouses, delivery systems and beyond.

Every customer a potential thief

As the largest private-sector employers and providers of essential household goods, the supermarkets play an outsized role in public life. Indeed, they are such familiar places that technological developments there may fly under the radar of public attention.

Coles and Woolworths are both implementing technologies that treat the supermarket as a “problem space” in which workers are controlled, customers are tracked and profits boosted.

For example, in response to a purported spike in shoplifting, a raft of customer surveillance measures have been introduced that treat every customer as a potential thief. This includes ceiling cameras which assign a digital ID to individuals and track them through the store, and “smart” exit gates that remain closed until a purchase is made. Some customers have reported being “trapped” by the gate despite paying for their items, causing significant embarrassment.

At least one Woolworths store has installed 500 mini cameras on product shelves. The cameras monitor real-time stock levels, and Woolworths says customers captured in photos will be silhouetted for privacy.

A Woolworths spokesperson explained the shelf cameras were part of “a number of initiatives, both covert and overt, to minimise instances of retail crime”. It is unclear whether the cameras are for inventory management, surveillance, or both.

Workers themselves are being fitted with body-worn cameras and wearable alarms. Such measures may protect against customer aggression, which is a serious problem facing workers. Biometric data collected this way could also be used to discipline staff in what scholars Karen Levy and Solon Barocas refer to as “refractive surveillance” – a process whereby surveillance measures intended for one group can also impact another.

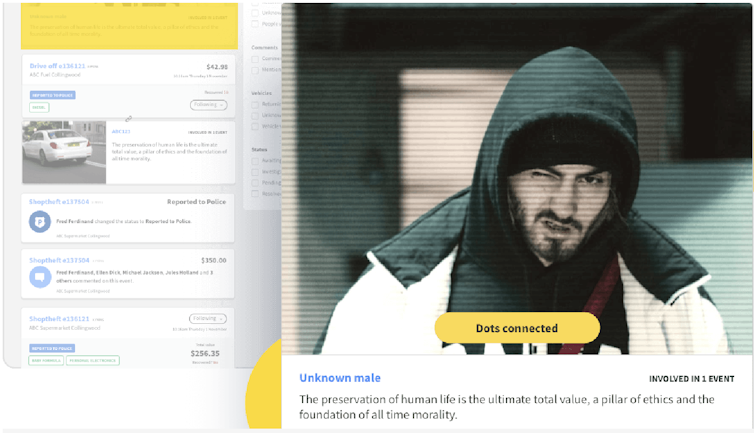

Predicting crime

At the same time as the supermarkets ramp up the amount of data they collect on staff and shoppers, they are also investing in data-driven “crime intelligence” software. Both supermarkets have partnered with New Zealand start-up Auror, which shares a name with the magic police from the Harry Potter books and claims it can predict crime before it happens.

Coles also recently began a partnership with Palantir, a global data-driven surveillance company that takes its name from magical crystal balls in The Lord of the Rings.

Read more: Solving the supermarket: why Coles just hired US defence contractor Palantir

These heavy-handed measures seek to make self-service checkouts more secure without increasing staff numbers. This leads to something of a vicious cycle, as under-staffing, self-checkouts, and high prices are often causes of customer aggression to begin with.

Many staff are similarly frustrated by historical wage theft by the supermarkets that totals hundreds of millions of dollars.

From community employment to gig work

Both supermarkets have brought the gig economy squarely inside the traditional workplace. Uber and Doordash drivers are now part of the infrastructure of home delivery, in an attempt to push last-mile delivery costs onto gig workers.

The precarious working conditions of the gig economy are well known. Customers may not be aware, however, that Coles recently increased Uber Eats and Doordash prices by at least 10%, and will no longer match in-store promotions. Drivers have been instructed to dispose of the shopping receipt and should no longer place it in the customer’s bag at drop-off.

In addition to higher prices, customers also pay service and delivery fees for the convenience of on-demand delivery. Despite the price increases to customers, drivers I have interviewed in my ongoing research report they are earning less and less through the apps, often well below Australia’s minimum wage.

Viewed as a whole, Coles’ and Woolworths’ high-tech measures paint a picture of surveillance and control that exerts pressures on both customers and workers. While issues of market competition, price gouging, and power asymmetries with suppliers must be scrutinised, issues of worker and customer surveillance are the other side of the same coin – and they too must be reckoned with.