Budget update forecasts deficit of $1.1 billion this financial year

The federal budget is headed for a small $1.1 billion deficit this financial year, according to the update released by Treasurer Jim Chalmers and Finance Minister Katy Gallagher on Wednesday morning.

This is an improvement of $12.8 billion compared to the deficit forecast in the May budget.

It suggests the final figure for the financial year might end up a surplus. If so, that would be the second year the Albanese government delivered a surplus.

Anxious to continue the fight against inflation, the government has not used the update to provide any cost-of-living relief or make new announcements. It has concentrated on improving the budget bottom line.

It has returned 92% of the upward revisions in revenue since the budget to the bottom line.

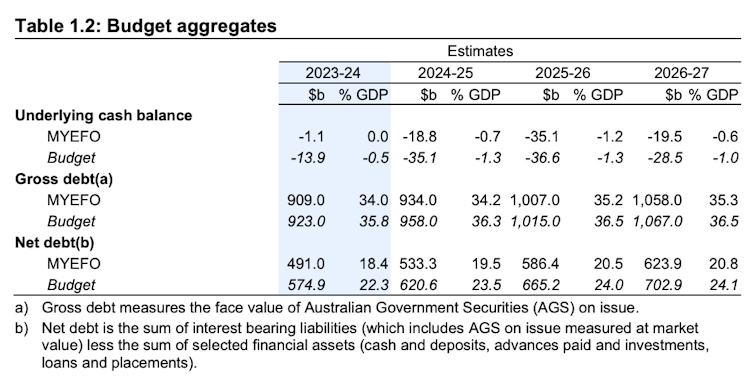

The Mid-Year Economic and Fiscal Outlook (MYEFO) shows deficits across all four years of the forward estimates. But over these years, the forecast underlying cash balance improves by a cumulative $39.5 billion compared to what was projected in the May budget.

Total receipts are projected to be $67.3 billion higher than the budget forecast. A strong labour market and high commodity prices have contributed to the improved revenue.

A further $9.8 billion has been identified in savings and reprioritisations since the budget. This has brought the total to nearly $50 billion since the election. A large part of the current savings comes from cuts and delays in the infrastructure program.

Net new spending since the budget is $650 million in 2023-24.

Chalmers and Gallagher said in a statement that in face of high but moderating inflation, high interest rates and global uncertainty the Australian economy was slowing.

“Growth is forecast to moderate in the near-term as these pressures weigh on domestic activity.” they said.

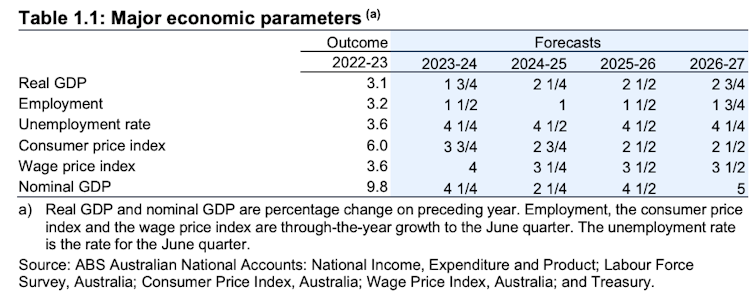

The economy is expected to grow by 1.75% in 2023-24 before regaining momentum in 2024-25, when improved real incomes are expected to support a recovery in household consumption.

While global oil prices have put upward pressure on inflation in the near-term, Treasury has not changed its forecast timetable for inflation’s return to the 2-3% target band.

The ministers said: “We know many Australians are doing it very tough, but welcome and encouraging progress is being made […] in the fight against inflation and in the economy more broadly”.

Unemployment, which was 3.7% in October, is forecast to rise to 4.25% by the end of this financial year. The unemployment forecast hasn’t changed since the budget.

Gross debt as a share of GDP is expected to peak at 35.4% of GDP in 2027-28, then decline to 32.1% by the end of the medium term.