A very different country: 2060s Australia as seen by the Intergenerational Report

The Australia of the 2060s will be very different from the one we know today. It will be older, with slower economic growth, a big “care” economy, and an export sector that is radically transformed due to the imperatives of climate change.

The Intergenerational Report, released by Treasurer Jim Chalmers, says five main forces will shape Australia’s economy over the coming four decades.

They are:

-

population ageing

-

expanded use of digital and data technology

-

climate change and the net zero transformation

-

rising demand for care and support services

-

increased geopolitical risk and fragmentation.

These forces will “change how Australians live, work, and engage with the world”.

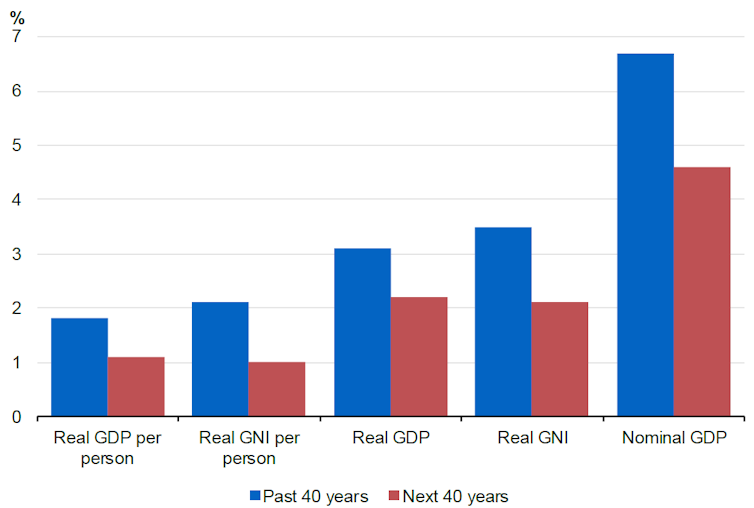

The economy will be about two and a half times as big, and real incomes are expected to be 50% higher by 2062-63. On the downside, economic growth will be slow – growing at an average pace of 2.2% over the coming four decades, from an average of 3.1% over the previous four decades.

Average annual growth

Population will also increase more slowly than previously – by an average of just 1.1% annually. The report projects 40.5 million people in the early 2060s. Migration is projected to fall as a share of the population. While the number of people 65 and over will double, Australia is still expected to have a younger population than most advanced countries.

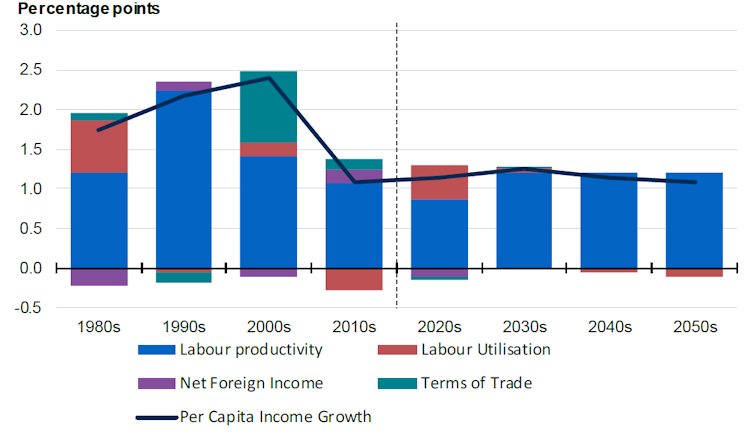

With an ageing population, the rate of participation in the workforce is expected to fall gradually – from 66.6% in 2022-23 to 63.8%. Average hours worked would also fall slightly, from about 32 to about 31 a week. The gender pay gap would continue to narrow.

Productivity growth will remain in the slow lane, although its future path is

not a foregone conclusion and will be influenced by decisions taken by government, business, and investors, and by the big shifts underway in the global and domestic economy.

Changes in Australia’s industrial base will be driven by technology, climate change and the energy transformation, and the growing demand for care and support services, as well as geopolitical uncertainty.

The net zero transformation will hit coal exports, but boost the export of so-called critical minerals.

“Climate change and the net zero transformation will have a significant impact on the structure of the economy and the choices Australian consumers and businesses make,” the report says.

Australia is in a strong position to benefit with some of the world’s largest reserves of critical minerals such as lithium, cobalt and rare earth elements, which are key inputs to clean energy technologies. With abundant wind, sun and open spaces Australia also has the potential to generate green energy more cheaply than many countries.

The report warns that domestically, climate change will affect how we live and work, as well as food and energy security, and the environment.

The ageing population will strengthen the trend towards a service-based economy, with the care and support sector potentially doubling over the coming four decades.

Components of real income growth per capita

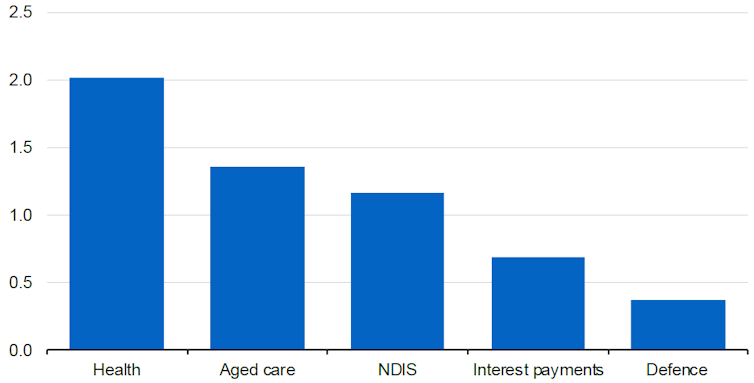

The budget in 40 years will see already-familiar spending pressures – in health, aged care, the National Disability Insurance Scheme, defence, and debt interest.

Collectively, these are projected to increase from about a third to about a half of all government spending.

Total government spending is projected to rise by 3.8 percentage points of GDP over the next 40 years. About 40% of this increase is caused by ageing.

Total income support and education payments are expected to continue to rise in real terms per person but fall as a share of GDP as Australia ages. Spending on age and service pensions will fall as a share of GDP, with superannuation increasingly funding retirement.

Increase in payments across the five main spending pressures

Per cent of GDP, 2022–23 to 2062–63

There will be pressure in the coming 40 years on the revenue base, which will be eroded by the decarbonisation of transport and also a hit to tobacco excise.

Australia’s gross debt as a share of GDP is set to decline over coming decades, but there will be deficits. The budget is currently in surplus but the report says “deficits are projected to remain over the long term”. Initially narrow. they will widen from the 2040s because of spending pressures.

Launching the report at the National Press Club Chalmers said the government’s immediate obligation was to do what it could to ease cost-of-living pressures without adding to inflation.

“But the critics out there who say that we need to wait before engaging with our long-term prospects just don’t seem to get it,” he said.

“There will never be a quiet time to think about the future. There will always be competing pressures and urgent calls on our attention.

“The best leaders can focus on more than one thing, more than one horizon, more than one set of opportunities.”

Answering questions, Chalmers acknowledged the uncertainty in long-term projections.

“There’s always an element of uncertainty; there will always be things like global financial crises and pandemics that will knock a country off course and make us think about the starting point differently and, therefore, the end destination differently as well. So none of it is preordained.”

Read more: Slower ageing, but slower economic growth: the Intergenerational Report in 7 charts