An International Perspective on Monetary Policy Implementation Systems

interest rates, international, market operations, monetary policy, pandemic

Photo: Yuichiro Chino – Getty Images

Abstract

In response to the COVID-19 pandemic and building on policies introduced during the global financial crisis, central banks in advanced economies deployed balance sheet policies to support their economies and address disruptions to the smooth functioning of financial markets. The introduction of these policies has changed how most of these central banks implement their primary policy tool – the policy rate. This article describes how many central banks transitioned from a corridor system of monetary policy implementation to a de facto floor system. It also details the range of implications of choosing a floor system. While this transition may prove to be temporary for some central banks, others have signalled that they expect to retain a floor system in the long term.

Introduction

Central banks in advanced economies implement monetary policy using a variety of policy tools. The primary policy tool used by many central banks is the policy interest rate (or target for the policy rate, shortened to ‘policy rate’ hereafter); however, other tools can also be used, including forward guidance, price or quantity targets for asset purchases, and the provision of low-cost, long-term funding to banks. Central banks generally make use of similar incentives to align one or more short-term market interest rates with the policy rate. These incentives are a key element of most monetary policy implementation frameworks.

Most central banks in advanced economies use frameworks that influence the interest rate at which banks lend and borrow funds to each other on an overnight basis (the ‘overnight interbank rate’). The overnight interbank rate, in turn, influences other short-term market rates as part of the monetary policy transmission mechanism. There are five aspects of the market for overnight interbank funding, which help explain how these frameworks operate:

- Price: the price of funding is the interest rate banks charge to lend funds to other banks overnight.

- Quantity: the quantity of funds in this market is made up of bank reserves balances, which are at-call deposits banks hold at the central bank and use to settle payment obligations with other banks. Banks are required to have a non-negative balance of reserves at all times, and some central banks also require balances to be above zero (or at least to average some specified amount over time). It can be difficult for banks to predict whether they will have adequate funds on any given day; depending on their needs on the day, banks may trade reserves with one another in the interbank overnight cash market to ensure they have sufficient funds to settle all payment obligations.

- Demand: this is the aggregate level of reserves banks want to hold. Demand can vary for many reasons, including changing financial market conditions.

- Supply: this is the level of reserves available to banks. Transactions between a central bank (and its clients, such as the government) and commercial banks (and their clients) change the supply of reserves throughout the day. Central banks can control the supply of reserves through open market operations (OMOs) and other transactions that can inject reserves into, or drain reserves from, the payments system.

- Standing facilities: central banks provide banks with access to deposit and lending facilities – together known as ‘standing facilities’ – which create a range of interest rates that provide banks with an incentive to trade reserves among themselves. The interest rate on a central bank’s deposit facility (the ‘deposit rate’) is the overnight rate it pays banks on their reserve holdings. The interest rate on a central bank’s lending facility (the ‘lending rate’) is the overnight rate banks pay to borrow reserves from the central bank. Banks have no incentive to lend reserves to each other at a rate below the deposit rate because they can earn a higher return by using the deposit facility. Similarly, banks should have no incentive to borrow reserves from each other at a rate above the lending rate because they can pay less to use the central bank’s lending facility.

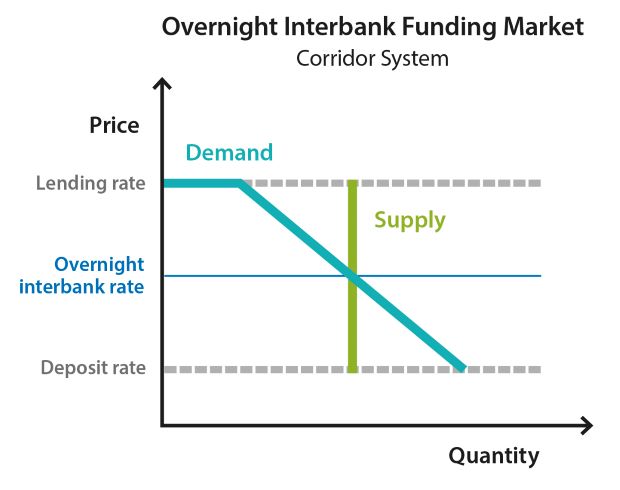

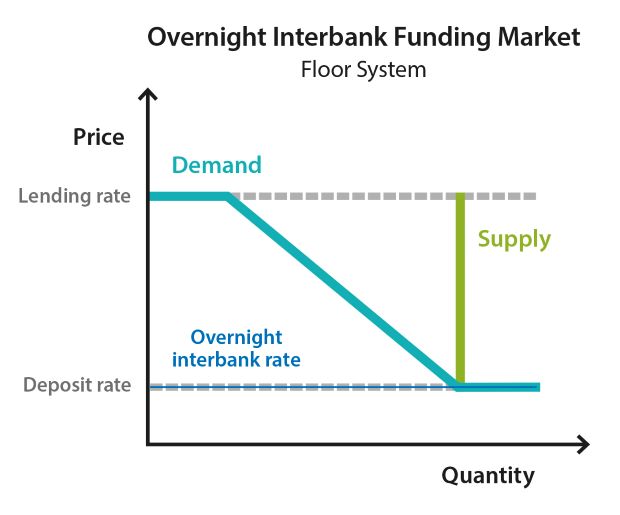

Where the overnight interbank rate settles between the deposit rate and the lending rate is determined by the supply of, and demand for, reserves. In recent history, central banks have generally used two types of monetary policy implementation systems within their frameworks: a corridor system; and a de facto floor system (shortened to ‘floor system’ hereafter). The key element that distinguishes these systems is the supply of reserves.

As shown in Graph 1, under a corridor system, reserves are intentionally scarce and central banks use OMOs to fine tune the supply of reserves so that the overnight interbank rate trades to be close to the policy rate (which is often set in the middle of the rate corridor) (Domestic Markets Department 2019). For example, if the supply of reserves falls – perhaps because large amounts of tax are being paid into a government account at the central bank – the central bank will supply reserves to keep the overnight interbank rate close to the policy rate. Similarly, a central bank will supply reserves if there is an increase in the demand for reserves. Larger shocks to the demand for, or supply of, reserves will require a central bank to add or withdraw a greater quantity of reserves to keep the overnight interbank rate close to the policy rate. As reserves are scarce, banks have to manage their daily funding requirements by actively trading reserves with one another in the overnight funding market.

Graph 1

By contrast, under a floor system a central bank supplies a level of reserves that is in excess of demand. In other words, the supply curve sits on the flat part of the demand curve, as shown in Graph 2. The overnight interbank rate typically settles to be relatively close to the deposit rate. This is because the excess level of liquidity means there are plenty of banks with surplus funds willing to lend, and so those banks that need to borrow do not need to pay rates much above the deposit rate to obtain funding in this market. In this system, a central bank does not need to regularly fine tune the amount of reserves and typically only needs to conduct OMOs if there is a large shock to demand or supply of reserves.

Graph 2

Balance sheet policies and the transition from a corridor to a floor system

In response to the COVID-19 pandemic and building on policies introduced during the global financial crisis (GFC), most central banks in advanced economies engaged in balance sheet policies, including large-scale asset purchases and lending schemes. These measures materially increase the supply of reserves because balance sheet policies are funded by the creation of central bank reserves. For the US Federal Reserve (Fed) and the Bank of England (BoE), reserve liabilities increased significantly in the years following the GFC (Graph 3) (Ng and Wessel 2019; BoE 2021). For the European Central Bank (ECB), reserve liabilities fluctuated in the years following the GFC and the European debt crisis, and increased more permanently from around 2015 (Cerclé, Monot and Le Bihan 2021).

Graph 3

In response to the large increase in reserves that were far in excess of demand (hence they were commonly referred to as being ‘abundant’), most central banks transitioned to a floor system. The Reserve Bank of New Zealand (RBNZ) and the Bank of Canada (BoC) transitioned to floor systems following the COVID-19 crisis, joining those other central banks in advanced economies that followed a similar path following the GFC. At present, the Reserve Bank of Australia (RBA) is effectively operating a floor system owing to the large amount of liquidity in the payments system (Debelle 2021). By contrast, Sveriges Riksbank (the Riksbank) has maintained a corridor system that relies on draining a material proportion of reserves created by its asset purchases to steer short-term market interest rates close to its policy rate target (Sveriges Riksbank 2022a).

As central banks have transitioned to floor systems, OMOs have become less prominent. In general, the value transacted is smaller, and the operations are conducted less frequently. The abundant liquidity in the payments system means central banks no longer need to fine tune the supply of reserves to meet demand. However, most central banks continue to use OMOs at least on an ad hoc basis, typically to provide term liquidity or liquidity when market conditions deteriorate and demand for reserves increases (Schrimpf, Drehmann and Cap 2020). The continued operation of OMOs also ensures that banks retain operational links with the central bank and maintain the operational capacity to obtain reserves under OMOs.

The different ways to express the policy rate

Some central banks express their policy decision in terms of one or more of the interest rates they administer, commonly the deposit rate. Other central banks express it as a target for one or more market interest rates. The target may be a range of values or a single value, and the relevant market interest rate may cover unsecured or secured borrowing (or both). A summary of selected central bank policy rates is shown in Table 1.

The ECB, the BoE, the RBNZ and the Riksbank express policy in terms of one or more administered rates. The ECB sets three key interest rates: the rate on the deposit facility; the rate on the main refinancing operations (MRO); and the rate on the marginal lending facility (ECB 2022). The BoE and the RBNZ explicitly set the policy rate equal to the deposit rate, while the Riksbank defines the policy rate as the interest rate at which banks can borrow or deposit funds at the Riksbank for a period of seven days.

By contrast, the Fed, the BoC and the RBA express the key policy rate as a target for one or more key money market rates. The Fed specifies a target range, while the BoC and the RBA specify a target value. In recent years, the Fed, the BoC and the RBA have all adjusted where the target rate (or the midpoint of the target range for the Fed) sits in relation to its deposit and lending rates. For example, since March 2020, the BoC has set its deposit rate equal to its target for the overnight rate (BoC 2022b). Targets for the policy rate vary across these central banks; while the Fed and the RBA target a market rate based on unsecured transactions, the BoC considers a range of market rates, including the Canadian Overnight Repo Rate Average (CORRA) which is based on secured transactions.

| Policy rate | Rate type | Rate description | |

|---|---|---|---|

| ECB | Deposit facility rate | Administered rate | Interest rate on excess bank reserves(a) |

| BoE | Bank rate | Administered rate | Interest rate on bank reserves(b) |

| RBNZ | Official cash rate | Administered rate | Interest rate on bank reserves |

| Sveriges Riksbank | Policy rate | Administered rate | Interest rate at which banks can borrow or deposit funds at the Riksbank for a period of seven days |

| Fed | Target range for federal funds rate | Market rate target | Targets interest rate on unsecured overnight loans between banks and certain other entities, primarily government sponsored enterprises |

| BoC | Target for overnight rate, which is proxied by multiple indicator rates; one key indicator rate is the CORRA | Market rate target | Targets interest rate at which major participants in the money market borrow and lend overnight funds among themselves; CORRA measures the cost of overnight general collateral funding in Canadian dollars using Government of Canada securities as collateral for repo transactions |

| RBA | Cash rate target(c) | Market rate target | Targets interest rate on unsecured overnight loans between banks |

|

(a) The ECB requires credit institutions established in the euro area to hold a minimum level of reserves that are remunerated at an interest rate equivalent to the MRO rate (ECB 2016). Reserves in excess of the minimum requirement are referred to as excess bank reserves. Since September 2019, the ECB has used a two-tier system to remunerate banks’ excess reserves (ECB 2019). Sources: Federal Reserve Bank of New York (2022); ECB (2022); BoE (2022a); BoC (2022c); BoC (2022d); RBA (2022a); RBNZ (2020); Sveriges Riksbank (2022b) |

|||

Irrespective of how a central bank defines the policy rate, at present key short-term market rates tend to trade below the policy rate (which, in many cases, equals the deposit rate) (Graph 4). The negative spread between market rates and policy rates in part reflects that the market rates consider bank borrowing costs from non-bank entities that do not have access to central bank deposit facilities. In Australia, the cash rate sits below the RBA’s cash rate target but above the deposit rate because: the cash rate is based on unsecured overnight loans between banks, and so there is no incentive to lend below the deposit rate; and these banks require compensation for lending to a commercial bank rather than depositing money at the RBA.

Graph 4

The implications of choosing a floor system

There are a range of implications of choosing to operate a floor system, including:

- Balance sheet flexibility. Under a floor system, a central bank can implement balance sheet policies, and so expand its supply of reserves, without affecting the rest of its operational framework. In economies where the effective lower bound for central bank policy rates may be binding with some frequency, such polices may be required more often. Consequently, it could be valuable for central banks to adopt an approach that functions consistently throughout the cycle. Recent experience suggests that central banks can shift from a corridor system to a floor system without difficulty. However, transitioning from a floor system to a corridor system could be more difficult if overnight interbank market function is poor (see below) or market participants do not have familiarity with central bank operations or the operational capacity to obtain reserves under OMOs (see above).

- Simplicity and automation. Regular discretionary OMOs are generally unnecessary under a floor system because day-to-day disturbances to the demand for or supply of reserves can generally be absorbed without materially affecting overnight lending rates between banks. However, the significant volatility in money market rates experienced in the United States as the Fed reduced its balance sheet in 2018–2019 highlighted that it is challenging to determine an adequate supply of reserves (Anbil, Anderson and Senyuz 2020; Logan 2019); it also highlighted the importance of having facilities or tools, such as OMOs, available to maintain good control of overnight rates.

- Financial stability. A high level of reserves can help to improve the efficiency of the payments system as system liquidity plays a role in the timely settlement of transactions. Plentiful reserves for all participants can also support financial stability by reducing the need for central bank intervention in financial markets in times of stress.

- Financial neutrality. There is a risk that a central bank unintentionally influences financial asset prices or impedes market functioning by buying and holding assets that back the additional reserves required under a floor system. Very large holdings of assets, particularly government bonds, may also create a heightened risk of fiscal dominance (a scenario in which a fiscal authority cannot finance itself entirely by new bond sales and so the monetary authority is forced to buy bonds and tolerate additional inflation (Wallace and Sargent 1981)) and the perception that the central bank is financing the government, which in turn may compromise a central bank’s ability to deliver its core mandate (Hauser 2021).

- Risks and resources of implementing monetary policy. A central bank holds more assets when operating a floor system compared with a corridor system. Depending on the types of assets held, larger holdings of assets can expose a central bank to more market risk, credit risk and, for parts of the economic cycle, the potential for negative net interest income (i.e. paying more on interest on reserves than is received through holding assets). A permanently expanded balance sheet can also be more costly to operate and to manage the risks involved.

- Reduced trading volumes in overnight interbank markets. In an environment of high reserves, banks are more likely to hold a level of reserves sufficient to meet their day-to-day liquidity needs. As a result, they are less likely to need to borrow from each other in the overnight interbank market and so trading volumes in that market will fall. This could potentially reduce the health of the market, reduce the ability of market participants to deal with disruptions by themselves, and impede monetary policy transmission. However, evidence suggests that short-term interest rates have remained well anchored under floor systems over recent years (Aziz et al 2022; Logan 2019; Hauser 2019).

Retaining a floor system in the long term

As economic recoveries have progressed and inflation has risen further and more persistently above central bank targets than previously expected, central banks in advanced economies have begun to withdraw elements of the extraordinary monetary policy support they provided in the wake of the outbreak of COVID-19. Some have already started to reduce their holdings of government bonds by allowing purchased assets to mature; at the same time, amounts borrowed by banks under lending schemes are due to be repaid in coming years. Market participants expect this process to continue in the years ahead. As balance sheet policies roll off at each central bank, reserves will decrease from previously abundant levels and eventually reach a point where they are no longer scarce.

Ahead of reserves reaching scarcity, central banks may re-evaluate their preferred choice of monetary policy implementation system. Some may decide to continue using a floor system and so maintain a higher level of reserves, while others may allow reserves to decline and return to a system where the policy rate trades closer to the middle of a corridor. Central banks will weight differently the implications of a floor system as described above, taking into account the structure of their markets and how the monetary policy transmission mechanism works in their respective economies. The BoE, the Fed, the BoC and the RBNZ have indicated that they expect to continue using a floor system in the long term (Hauser 2019; Logan 2019; BoC 2022a; RBNZ 2022).

Conclusion

Following the introduction of balance sheet policies either during the GFC or the COVID-19 pandemic, most central banks in advanced economies made significant changes to their monetary policy implementation systems. The use of balance sheet policies led to a large increase in the amount of central bank reserves in the financial system. In response to abundant reserves, most central banks transitioned to a floor system over this time. There are a range of implications to choosing a floor system, such as flexibility to accommodate balance sheet policies, and the contribution of abundant reserves to the operation of payments systems and to financial stability. While this transition may prove to be temporary for some central banks, others have signalled that they expect to continue using a floor system in the long term.

References

Anbil S, A Anderson and Z Senyuz (2020), ‘What Happened in Money Markets in September 2019’, FEDS Notes, 27 February.

Aziz A, C de Roure, P Hutchinson and S Nightingale (2022), ‘Australian Money Markets through the COVID-19 Pandemic’, RBA Bulletin, March.

BoC (Bank of Canada) (2022a), ‘Bank of Canada Provides Operational Details for Quantitative Tightening and Announces that It Will Continue to Implement Monetary Policy Using a Floor System’, Market Notice, 13 April.

BoC (2022b), ‘Framework for Market Operations and Liquidity Provision’. Available at <https://www.bankofcanada.ca/markets/market-operations-liquidity-provision/framework-market-operations-liquidity-provision/>.

BoC (2022c), ‘Methodology for Calculating the Canadian Overnight Repo Rate Average (CORRA)’. Available at <https://www.bankofcanada.ca/rates/interest-rates/corra/methodology-calculating-corra/>.

BoC (2022d), ‘Policy Instrument’. Available at <https://www.bankofcanada.ca/rates/indicators/key-variables/policy-instrument/#over>.

BoE (Bank of England) (2021), ‘Bank of England Balance Sheet and Weekly Report’, 5 October. Available at <https://www.bankofengland.co.uk/weekly-report/balance-sheet-and-weekly-report>.

BoE (2022a), ‘Bank of England Market Operations Guide: Our Objectives’, Bank of England Market Operations Guide, 7 April.

BoE (2022b), ‘Bank of England Market Operations Guide: Our Tools’, Bank of England Market Operations Guide, 7 April.

Cerclé E, M Monot and H Le Bihan (2021), ‘Understanding the Expansion of Central Banks’ Balance Sheets’, Banque de France Eco Notepad, Post No 209, 25 March.

Debelle G (2021), ‘Monetary Policy During COVID’, Shann Memorial Lecture, Online, 6 May.

Domestic Markets Department (2019), ‘The Framework for Monetary Policy Implementation in Australia’, RBA Bulletin, June.

ECB (European Central Bank) (2016), ‘What Are Minimum Reserve Requirements?’, Explainer, 11 August.

ECB (2019), ‘ECB Introduces Two-tier System for Remunerating Excess Liquidity Holdings’, Press Release, 12 September.

ECB (2022), ‘Key ECB Interest Rates’. Available at <https://www.ecb.europa.eu/stats/policy_and_exchange_rates/key_ecb_interest_rates/html/index.en.html>.

Federal Reserve Bank of New York (2022), ‘Effective Federal Funds Rate’. Available at <https://www.newyorkfed.org/markets/reference-rates/effr>.

Hauser A (2019), ‘Waiting for the Exit: QT and the Bank of England’s Long-term Balance Sheet’, Speech to the European Bank for Reconstruction and Development, London, 17 July.

Hauser A (2021), ‘Bigger, Broader, Faster, Stronger? How Much Should Tomorrow’s Central Bank Balance Sheets Do – and What Should We Leave to Financial Markets? Some Principles for Good Parenting’, Speech to the International Finance and Banking Society’s Conference on ‘The Financial System(s) of Tomorrow’, Oxford, 13 September.

Hawkesby C (2020), ‘COVID-19 and the Reserve Bank’s Balance Sheet’, Speech to KangaNews New Zealand Capital Markets Forum, Wellington, 20 August.

Logan L (2019), ‘Observations on Implementing Monetary Policy in an Ample-Reserves Regime’, Remarks to the Money Marketeers of New York University, New York City, 17 April.

Ng M and D Wessel (2019), ‘The Fed’s Bigger Balance Sheet in an Era of ‘Ample Reserves’’, Brookings, 17 May.

RBA (Reserve Bank of Australia) (2022a), ‘Cash Rate Target’. Available at <https://www.rba.gov.au/statistics/cash-rate/>.

RBA (2022b), ‘How the Reserve Bank Implements Monetary Policy’, Explainer.

RBA (2022c), ‘Unconventional Monetary Policy’, Explainer.

RBA (2022d), ‘Minutes of the Monetary Policy Meeting of the Reserve Bank Board’, Hybrid, 5 April.

RBNZ (Reserve Bank of New Zealand) (2020), ‘Reserve Bank Announces New Facility and Removal of Credit Tiers’, Media Release, 20 March.

RBNZ (2022), ‘Reserve Bank Optimising New Zealand’s Monetary Policy Implementation Framework for the Future’, Media Release, 6 May.

Schrimpf A, M Drehmann and A Cap (2020), ‘Changes in Monetary Policy Operating Procedures Over the Last Decade: Insights from a New Database’, BIS Quarterly Review, 7 December.

Sveriges Riksbank (2022a), ‘The Riksbank is Making the Operational Framework More Flexible’, Press Release, 22 March.

Sveriges Riksbank (2022b), ‘Policy Rate, Deposit and Lending Rate’, 14 June. Available at <https://www.riksbank.se/en-gb/statistics/search-interest–exchange-rates/policy-rate-deposit-and-lending-rate/>.

Wallace N and TJ Sargent (1981), ‘Some Unpleasant Monetarist Arithmetic’, Federal Reserve Bank of Minneapolis Quarterly Review, 5(3), pp 1–17,

Source: Reserve Bank of Australia [2021]