How Far Do Australians Need to Travel to Access Cash?

atm, banking, banknotes, currency

Photo: Glow Images – Getty Images

Abstract

Our analysis finds that Australians generally do not have to travel far to reach their nearest cash access point – a location where they may make cash withdrawals and/or deposits. Around 95 per cent of people live within about 5 kilometres of a cash access point, broadly unchanged since 2017. However, there are parts of regional and remote Australia with limited access to cash. People in these areas must travel longer distances to access cash, and the available access points do not always have nearby alternatives. This means that access to cash in these areas is more vulnerable to any future removal of cash services.

Introduction

Cash use in Australia has been declining for some time. The Reserve Bank of Australia’s (RBA’s) Consumer Payments Survey (CPS) showed that cash accounted for 27 per cent of payments in 2019, down from 69 per cent in 2007 (Graph 1, LHS). The number of cash withdrawals in Australia has also fallen over this period; for example, the number of ATM withdrawals has halved from over 70 million withdrawals per month in the early 2010s to around 35 million in recent months (Graph 1, RHS). Coming on top of the long-run decline, the COVID-19 pandemic has resulted in a further downward shift in cash use and withdrawals (Guttmann et al 2021).

Graph 1

At the same time, cash remains an important payment method in Australia. Cash is a default fee-free payment option for people to use in stores, as card transactions are sometimes surcharged. In addition, some businesses and consumers rely heavily on cash to make or receive payments. For example, 15 per cent of respondents in the 2019 CPS used cash for 80 per cent or more of their payments; these high cash users were more likely to be older Australians living in regional areas and less likely to have access to the internet (Delaney, McClure and Finlay 2020). Around a quarter of respondents also indicated that they would suffer major inconvenience or genuine hardship if cash could no longer be used as a method of payment. Another reason why cash remains an important payment method is that it is a backup option during outages in electronic payment systems.

For cash to be able to be widely used, Australians must be able to easily withdraw and deposit it. The Reserve Bank of Australia (RBA 2021a), as part of its 2020/21 Corporate Plan, has committed to work to support the ongoing provision of cash services in Australia. This article contributes to this goal by examining Australians’ distance to cash access points.

We first define a cash access point, then measure the population’s distance to these points. We then identify gaps in cash access points and consider the robustness of access to any further rationalisation in cash services.

Cash access points

There are several types of cash services, or cash access points, available to Australians:

- ATMs, which are widely used across the community to withdraw cash (some also accept deposits)

- bank branches, which allow customers of that bank to withdraw and deposit cash

- Australia Post’s Bank@Post outlets, which offer cash withdrawals and deposits for customers of more than 80 authorised deposit-taking institutions (ADIs), including 3 major banks; these outlets are considered as ADI access points for the remainder of this note.

Outside of these ‘formal’ cash access points, Australians can also obtain cash at the point of sale (i.e. eftpos cash-out, which is offered by some merchants), or by receiving payments and gifts in cash. These are beyond the scope of this article.

The number of cash access locations has been decreasing in Australia alongside the reduction in cash use and withdrawals. The total number of active ATMs across all deployers has fallen by around 20 per cent (or 6,500 machines) since its peak in late 2016 (Graph 2, LHS). The decline in ATMs owned by banks has been greater than that of independent deployers over this period. This reflects industry efforts to improve efficiency and the recent decisions by some banks to sell parts or all of their off-branch ATM fleets to independent deployers. The network of full-service bank branches also declined by around 20 per cent (or 1,400 branches) over the decade to mid 2020 (the latest available official data; Graph 2, RHS). Banks have continued to close branches since this time; parliamentary testimonies from the 4 major banks indicate more than 220 branches have been closed or are due to close (on net) since then (see Parliament of Australia Standing Committee on Economics (2021)), and there have been significant branch closures announced by some smaller banks.

Graph 2

Despite the decline in the aggregate quantity of cash access points in Australia over recent years, around 90 per cent of 2019 CPS respondents still indicated that access to cash withdrawal services was ‘convenient’ or ‘very convenient’ (with access to cash deposit services somewhat less convenient) (Caddy, Delaney and Fisher 2020). This may be because the removal of cash access points has typically been concentrated in metropolitan regions where there are multiple nearby alternatives – for example, the removal of some ATMs co-located at shopping centres. Understanding the location, as well as the number, of cash service points is therefore important to evaluating Australians’ access to cash. A number of other factors are also relevant to cash access, but these are largely beyond the scope of this article. For example, all cash points are not equivalent: bank branches typically only service customers of that bank; not all banks subscribe to the Bank@Post service and so customers of some banks cannot use these facilities; and some people may require ‘face-to-face’ branch services and are therefore not well served by ATMs. Fees for cash withdrawals and deposits (for example, ATM withdrawal fees) may also impact people’s access to cash.

To assess the geographic distribution of access to cash withdrawal and deposit services, we draw upon and update the method used in Delaney, Finlay and O’Hara (2019). Specifically, we use the following data:

- the ADIs’ Points of Presence publication by the Australian Prudential Regulation Authority (APRA), which provides the location of all ATMs and branches of ADIs (i.e. banks, credit unions and building societies), as well as all Australia Post Bank@Post outlets and other face-to-face ADI points (which may not offer all the services available at full-service branches), as of June 2020

- ATM data sourced directly from a number of independent ATM deployers. The data include the location of ATMs operated by Banktech, Next Payments, Linfox Armaguard, and Prosegur. These data include roughly 6,800 ATMs, equivalent to around 40 per cent of all independently deployed ATMs. This means that we likely somewhat underestimate access to cash as the other machines doubtless expand the geographic footprint of access points

- fee-free ATMs set up in remote Indigenous communities. Under this program, participating commercial banks pay independent deployers to provide fee-free ATMs in remote parts of the Northern Territory, Queensland, Western Australia, and South Australia (Australian Banking Association 2017)

- the Australian Bureau of Statistics’ (ABS’) Australia Population Grid 2019, which presents Australia’s 2019 population in one square kilometre grids.

The data include access points that were temporarily closed during COVID-19-related lockdowns but does not incorporate changes in cash access points occurring since June 2020.

How far are Australians from cash withdrawal and deposit services?

Our analysis indicates that most Australians live relatively close to cash services (Table 1). As of June 2020, 95 per cent of Australians lived within 4.3 kilometres of an identified cash withdrawal point (which includes ATMs, branches, and Bank@Post outlets), and 5.5 kilometres of a cash deposit point; here and elsewhere, distances are measured as the shortest distance between 2 points (i.e. as the crow flies).

| June 2020 | Change from June 2017(a) | |||||

|---|---|---|---|---|---|---|

| Number | Distance in kilometres(b) | Number | Distance in kilometres(b) | |||

| 95 per cent | 99 per cent | 95 per cent | 99 per cent | |||

| ADI deposit(c) | 9,363 | 5.5 | 16.7 | −1,122 | 0.1 | −0.3 |

| ADI branches(d) | 5,816 | 10.0 | 30.1 | −1,091 | 0.8 | 2.1 |

| Bank@Post outlets | 3,547 | 5.7 | 17.4 | −31 | −0.1 | −0.7 |

| ADI withdrawal(e) | 18,984 | 4.9 | 16.3 | −5,316 | 0.1 | −0.2 |

| ADI ATMs | 9,621 | 9.3 | 34.2 | −4,194 | 0.4 | −0.5 |

| All identified withdrawal(e) | 25,767 | 4.3 | 14.8 | |||

| All identified ATMs | 6,783 | 6.5 | 24.6 | |||

|

(a) The changes in distance account for movements in population. That is, the distances are calculated using population data at different points in time. Sources: ABS; APRA; Australian Banking Association; Banktech; ggmap; Google; Next Payments; Linfox Armaguard; Prosegur; RBA |

||||||

The geographic accessibility of these services was generally little changed in the 3 years to June 2020, despite the reduction in the aggregate number of access points (Table 1). For example, in 2017, 95 per cent of the population lived 8.9 kilometres from an ADI withdrawal ATM, whereas in 2020 that distance increased to 9.3 kilometres. Access to ADI branches changed more noticeably than for other services, with the average distance to an ADI branch for 95 per cent of the population increasing by 0.8 kilometres since 2017.

The distance Australians have to travel to access cash differed significantly across service types. In particular, Bank@Post outlets, where both cash withdrawals and deposits can be made, continued to maintain higher geographic coverage: 95 per cent of Australians live within 5.7 kilometres of a Bank@Post outlet, compared with 9.3 and 10 kilometres, respectively, for ATMs and branches operated by ADIs (Table 1 and Graph 3). This is despite there being significantly more ADI ATMs and branches than Bank@Post outlets (see Table 1 and Graph 2). The importance of Bank@Post services to cash access across Australia is indicated by Bank@Post outlets being the closest ADI cash withdrawal point (including branches, ADI ATMs and Bank@Post outlets) for around 37 per cent of Australians in 2020, up from 29 per cent in 2017. The high geographic coverage of Bank@Post outlets likely relates to Australia Post’s performance standards, which require (among other items) that 85 per cent of non-metropolitan residents are located within 7.5 kilometres of an Australia Post retail outlet (Australia Post 2020).

Graph 3

Current gaps in cash access points

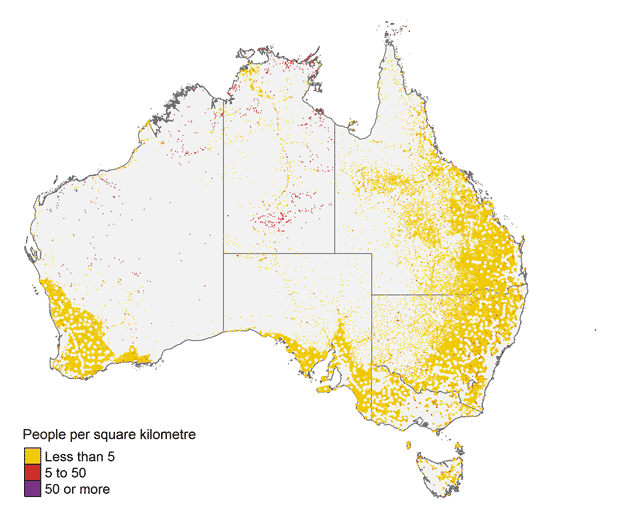

While most Australians lived reasonably close to cash access points, around 1 per cent – or around 250,000 people – lived more than 15 kilometres from their closest cash withdrawal location. As expected, these people generally lived outside major cities (Figure 1, Graph 4). For example, around 25 per cent of Australians in very remote regions had to travel more than 15 kilometres to the nearest cash access location, with a little over 5 per cent of people in these regions needing to travel more than 100 kilometres.

Areas with lower incomes or higher proportion of Indigenous people were more likely to be further away from cash access. The impact of less convenient access to cash in these areas may be heightened given there may also be higher cash use in these areas (Delaney, McClure and Finlay 2020) – for instance, people in a remote area that lacks reliable internet access are more likely to be dependent on cash for making payments. At the same time, it should be acknowledged that travel distances are generally larger for all services in remote areas.

Figure 1

Population with Least Access to Cash

People per square kilometre needing to travel more than 15 kilometres to access cash

Sources: ABS; APRA; Australian Banking Association; Banktech; ggmap; Google; Next Payments; Linfox Armaguard; Prosegur; RBA

Graph 4

Most towns (i.e. centres with a population of more than 1,000) continued to have at least one cash access point, although the average number of access points in towns has declined in recent years (Graph 5). The reduction in access points was generally greater in more populated towns, and was concentrated among ADI ATMs and bank branches. This suggests that rationalisation of access points in these towns has largely not had significant aggregate impact on cash access, because most removals have been in centres with multiple alternative cash access points (although closures may still be detrimental to local communities).

Graph 5

Nevertheless, the reduction in bank branches over the past few years in particular means that Bank@Post outlets have become more important at ‘filling in the gaps’ and providing access to cash deposit functionality in particular. The number of full-service bank branches fell by around 10 per cent between 2017 and 2020. While the closures were highest by number in metropolitan regions, a similar proportion of existing branches were closed across all areas (regional and remote areas lost around 270 full-service branches over this time). Correspondingly, the data suggest the number of towns that are ‘branchless’ has increased. Bank@Post outlets are therefore now the closest cash deposit point for 61 per cent of the population in very remote areas (compared with 57 per cent in 2017), and for around 55 per cent of Australians in regional areas (Graph 6). In 2020 there were 542 Bank@Post outlets that were 15 kilometres or further away from their nearest bank branch alternative; this is up from 488 outlets in 2017. These outlets were relatively more common in regional and remote Australia, reinforcing the importance of Bank@Post outlets for cash deposit access in these areas.

Graph 6

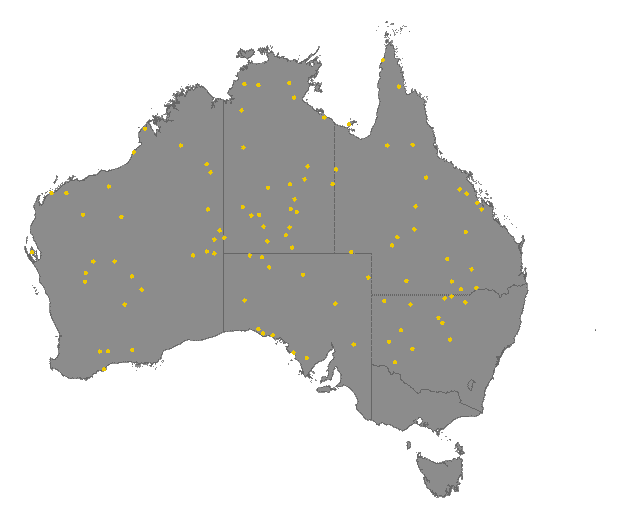

Robustness of cash access

Cash access points in remote areas tended to be more isolated from alternative points, meaning if someone’s nearest cash access point was not operating (due to either a temporary unavailability or its removal), they could face an even larger distance to their next closest cash access point. For example, based on our list of identified cash withdrawal points, we estimate around 100, or around 0.5 per cent of, access points did not have an alternative within 50 kilometres. Removal of access points like these could be significantly detrimental to cash access in these areas.

Figure 2

Most Remote Cash Access Point

Cash withdrawal points more than 50 kilometres from nearest alternative

Sources: ABS; APRA; Australian Banking Association; Banktech; ggmap; Google; Next Payments; Linfox Armaguard; Prosegur; RBA

In contrast to the vulnerabilities in remote areas, populations in regional and metropolitan areas typically had more accessible alternative cash access points if their nearest one was unavailable. For example, for people living within 30 kilometres of a cash access point, the average additional distance to the next closest access point was under 10 kilometres for both deposit and withdrawal points (Graph 7, bottom lines). Moreover, around 90 per cent of cash withdrawal points were within 1 kilometre of an alternative, indicating that many access points may be able to be removed without substantially increasing distance to cash access. Nevertheless, as the distance to the nearest cash access point grew, so did the additional distance to the next closest point; this reinforces that those who had to travel further to a cash access point (frequently, those in regional and remote areas) may be more vulnerable to further rationalisation of branches and ATMs.

Graph 7

This vulnerability may be partially offset by the composition of cash access points in remote areas. For example, remoter access points were often Bank@Post outlets or ATMs from the fee-free ATMs in remote Indigenous communities program. These access points may be less likely to be subject to commercial pressures, and so less likely to shut down; in 2017, for example, the fee-free ATMs program was extended for 5 years. In addition, cash-in-transit (CIT) companies Armaguard and Prosegur, which have each made large purchases of bank ATMs to set up their own fleets, have made public statements about expanding their ATM fleets and improving access to cash service points in regional areas (see Lekakis (2020a) and Lekakis (2020b)).

Conclusion

Access to cash services in Australia remains generally good – as of June 2020, 95 per cent of the population lived within 4.3 kilometres of a cash withdrawal point and 5.5 kilometres of a cash deposit point. These average distances were little changed compared with 2017, despite sizeable falls in the total number of cash access points in Australia over this period. However, some towns have more precarious access to cash, with few alternative access points nearby.

Ongoing declines in cash use and cash withdrawals are putting pressure on the economics of the cash system, which may prompt further rationalisation of ATM and bank branch networks in the future. Given the importance of cash in the payments system, the Bank will be continuing to study cash access and use in Australia. This will include work to understand the ongoing demand for cash by households for payments and other purposes – through regular CPSs and work to monitor the acceptance of cash by businesses. The Bank will also be considering potential measures that can help improve the efficiency of wholesale cash distribution, and will be undertaking a consultation on banknote distribution arrangements in the second half of this year (RBA 2021b).

References

Australia Post (2020), ‘Australia Postal Corporation Annual Report 2019-20’. Available at <https://www.transparency.gov.au/annual-reports/australian-postal-corporation/reporting-year/2019-20-78>.

Australian Banking Association (2017), ‘Fee-free ATMs to continue in remote communities’, ausbanking.org.au site, 22 December. Available at <https://www.ausbanking.org.au/fee-free-atms-to-continue-in-remote-communities/>.

Caddy J, L Delaney and C Fisher (2020), ‘Consumer Payment Behaviour in Australia: Evidence from the 2019 Consumer Payments Survey’, RBA Research Discussion Paper No 2020-06.

Chalmers S (2021), ‘Banks say branch closures no longer a sign of a town in decline as online shift accelerates, but locals still worried’, Australian Broadcasting Corporation, 30 April. Available at <https://www.abc.net.au/news/2021-04-30/branches-shut-as-online-banking-rises-but-small-towns-worried/100103484>.

Delaney L, N McClure and R Finlay (2020), ‘Cash Use in Australia: Results from the 2019 Consumer Payments Survey’, RBA Bulletin, June, viewed 8 April 2021. Available at <https://www.rba.gov.au/publications/bulletin/2020/jun/pdf/cash-use-in-australia-results-from-the-2019-consumer-payments-survey.pdf>

Delaney L, R Finlay and A O’Hara (2019), ‘Cash Withdrawal Symptoms’, RBA Bulletin, June, viewed 15 March 2021. Available at <https://www.rba.gov.au/publications/bulletin/2019/jun/cash-withdrawal-symptoms.html>

Guttmann R, C Pavlik, B Ung and G Wang (2021), ‘Cash Demand during COVID-19’, RBA Bulletin, March, viewed 13 April 2021. Available at <https://www.rba.gov.au/publications/bulletin/2021/mar/cash-demand-during-covid-19.html>

Hugo Centre (2020), ‘Accessibility/Remoteness Index of Australia (ARIA)’, arts.adelaide.edu site, 23 January. Available at <https://arts.adelaide.edu.au/hugo-centre/services/aria>.

Lekakis G (2020a), ‘Prosegur unveils Precinct brand in ATM war’, BankingDay.com site, 9 December. Available at <https://www.bankingday.com/prosegur-unveils-precinct-brand-in-atm-war>.

Lekakis G (2020b), ‘Armaguard pledges cash for the bush’, BankingDay.com site, 10 December. Available at <https://www.bankingday.com/armaguard-pledges-cash-for-bush>.

Parliament of Australia Standing Committee on Economics (2021), ‘Public Hearings’ Australia’s four major banks and other financial institutions: four major banks, 15 April. Available at <https://www.aph.gov.au/Parliamentary_Business/Committees/House/Economics/FourMajorBanks/Public_Hearings>.

RBA (Reserve Bank of Australia) (2020), ‘Payments System Board Annual Report 2020’. Available at <https://www.rba.gov.au/publications/annual-reports/psb/2020/>.

RBA (2021a), ‘Corporate Plan’, rba.gov site. Available at <https://www.rba.gov.au/about-rba/corporate-plan.html>.

RBA (2021b), ‘Payment Systems Board Update: May 2021 Meeting’, Media Release No 2021-07, 21 May. Available at <https://www.rba.gov.au/media-releases/2021/mr-21-07.html>.

Source: Reserve Bank of Australia [2021]