From the Archives: The London Letters

banking, educators and students, finance, history

Photo: Reserve Bank of Australia Archives PN-000271

Abstract

The Reserve Bank has a rich and unique archives that captures almost 2 centuries of primary source material about Australia’s economic, financial and social history. To enhance public access to these records, we have launched a digital platform, Unreserved. Unreserved enables users to browse information about our archival collection and directly access our digitised records. Unreserved will be regularly populated with new records as the digitisation of the Bank’s archives progresses. The first release of records is a ‘sampler’ of the diversity of information in our archives. This article introduces Unreserved and highlights a particular series – the London Letters – which comprises the information exchanged between the Bank’s head office and its London Office from 1912 to 1975. The London Letters provide insights into the development of Australia’s central bank, along with its role and experiences during some of the most significant events of the 20th century.

A new digital archive

The Reserve Bank is custodian of a rich and unique archives of records about Australia’s economic, financial and social history over almost 200 years. The extensive time span and scope of the records reflects the Bank’s lineage. They predate the Reserve Bank as it is known today because the organisation actually originated in 1911 as the Commonwealth Bank of Australia (CBA), which developed a central banking function and, at the time of its creation, had absorbed other banks with a colonial history. It was later, in 1960, that the central banking and commercial functions were separated, the organisation was renamed the Reserve Bank of Australia, and a new Commonwealth Banking Corporation was created (which would later be known as the CBA). Consequently, when we refer to the ‘Bank’, we mean the continuous central bank entity.

The significance of the Bank’s archival collection was described in an earlier Bulletin article, Being Unreserved: About the Reserve Bank Archives, which also foreshadowed plans to make our archives more accessible to the public. In March of this year, we released a digital archive, Unreserved. Unreserved enables users to independently research and download digital versions of key archival records, learn about the nature and scope of the Bank’s entire archival collection, and lodge requests for information or assistance from our archivists.

The process of digitising the Bank’s large archival collection is a major undertaking that has been underway for some years and will continue in the years ahead. The initial release of digitised records will include entire series for which there is sufficient metadata to accompany the records and support independent research by users. These series will also be diverse, in terms of subject matter and medium, so that they can be relevant to a wide range of users. The first tranche of digitised records to be released includes:

- colonial banking records – a set of records relating to 6 colonial banks operating in Australia during the nineteenth century. These records are from 1824 to 1935 and include convict banking records;

- the London Letters – a series of information sent between the Bank’s head office and its London Office from 1912 to 1975;

- the New York Agency records – a series of correspondence, banking records and financial vouchers for the Bank’s original New York Agency over its short period of existence from 1927 to 1929;

- the Papua New Guinea series – a series covering the creation of a financial system and central bank in Papua New Guinea, financial education, economic and financial surveys, and preparations for the transfer of activities to the Bank of Papua New Guinea ahead of the nation’s political independence;

- audio visual collections – various series of film, photographs and glass plate negatives covering the Bank’s buildings and staff during the First World War, the early built environment of Sydney and other locations in which there are Bank buildings, and the Bank’s activities in Papua New Guinea.

Together these digitised series provide a ‘sampler’ of the content of the Bank’s archives. They are accompanied by information about the Bank’s entire archival collection and key metadata for those series that are yet to be digitised.

Unreserved enables the release of some of our most fragile records along with items that people might find surprising for us to have in our collection. It also enables the wider public release of records about which the Bank has received requests in the past. Most importantly, Unreserved provides a vehicle for sharing unique primary source information about the nation’s economic, financial and social history – as seen by the central bank – and will ensure the preservation of this important archival collection.

In this article, we focus on the London Letters – a series that is unusual in its scale and continuity and which provides a detailed account of the central bank’s experience of some of the most significant events of the 20th century. We also describe how Unreserved can be used and the plans for future information releases.

The London Letters

The London Letters are quaintly called ‘Letters’ but include correspondence, briefings, reports, cables and data that were part of the regular exchange of information between the Bank’s head office and its London Office – which had been established to manage the Bank’s affairs in Britain (particularly government banking business) and provide safe transit of funds between Australia and Britain.

The regular exchanges of Letters ‘to and from’ London commenced during the planning of the Bank’s London Office building in 1912. The records form a continuous numbered series until 1975 (after which they form part of other series). As they cover the period 1912–1975, the London Letters include important records about the First World War and the consequent emergence of central banking in Australia, the Great Depression of the 1930s, the Second World War, development of post-war arrangements such as the Bretton Woods system, through to the exchange rate developments and commodity price shocks of the 1970s.

In addition to the episodes of economic history that can be explored in the London Letters, threads can be traced about individuals – the role that they played in particular events and their insights about prevailing issues. These include the Bank’s governors, prime ministers, treasurers and other politicians, public servants, academics and economists of the day. (They also contain staffing matters and in these records personal information has been redacted to enable the release of entire files of Letters ‘to and from’ London.)

There are some well-known individuals about whom there are substantive sets of records. Among the most well-known economists is Sir Otto Niemeyer of the Bank of England, who visited Australia in the 1930s to offer advice on the response to the crisis in Australia’s external finances that accompanied the Great Depression (with his contentious prescriptions contributing to the political crisis that resulted in the Australian Labor Party split of 1931). The London Letters also include records about Leslie Melville (later Sir), the eminent economist, academic and public servant who played a key role in the development of Australia’s central banking system and, over a lengthy period, represented Australia in many international forums, including at the Bretton Woods Conference. Furthermore, the Letters include reports by Thomas Balogh, a controversial and unconventional British economist from Hungary. Balogh rose to prominence at Oxford and would become an advisor to Britain’s Cabinet in 1964 and ultimately a senior minister and member of the House of Lords. His fulsome reports for the Bank on the British and European economies were invaluable in keeping the Bank up to date on world economic and political developments.

In addition, the London Letters contain correspondence relating to other people of note who were involved in important economic and financial events. With the Letters spanning 2 world wars and a depression, prominent people who are referenced, and about whom opinions were often given, include Winston Churchill, Franklin Roosevelt, Harry Truman, Lord Beaverbrook, Herbert Hoover, de Gaulle, Franco, Stalin, Hitler and Rommel.

This article provides examples of the type of content that can be found in the London Letters so that users of Unreserved can conduct their own searches.

The London Office

The London Letters reflect the development of the Bank’s London Office physically as well as its functions. The London Office opened for business on 20 January 1913 in rooms leased in Egypt House, New Broad Street – in the heart of the City of London. It was established when banks in London were the principal source of overseas funds for Australian borrowers, the principal intermediary for transactions with other nations, and when Britain was both Australia’s main export destination and source of foreign investment. The London Office initially kept Commonwealth Government accounts and conducted general banking business. Its functions grew rapidly and after only 5 months it opened a Savings Bank Department for use by emigrants, Australians, and later Australian soldiers. It also managed sterling reserves, exchange controls, forward exchange contracts, and government loans, along with assessing economic conditions. By 1915, the scale of its operations required leasing of additional space in the adjoining Friars House and, by 1917, a branch was opened in The Strand (in the recently completed Australia House). From 1929 the London Office operated out of Old Jewry (though in a full circle of history, the Bank’s current London premises are once again in New Broad Street).

Commonwealth Bank of Australia London Office, 36–38 New Broad Street, London, 1913, RBA Archives PN-000285

In addition to the economic insights afforded by records about the functions of the London Office, records about its physical development provide insights into business life in the City of London. They provide social and political perspectives, with the Manager of the London Office acting as the Bank’s ambassador in the City. And they give us a window into changes in technology and information security, as records take different forms and have different measures of safe handling as information traversed the globe during times of war through to the advent of mass air travel.

The First World War

The first and arguably greatest test for the Bank was the First World War. Only a few years after the original Commonwealth Bank of Australia had opened, it was required to quickly take its first steps towards becoming the nation’s central bank with the Australian Government calling on it to manage the financing of the war effort and establish its role as a national institution. At the same time, the Bank was contending with its own staff being sent to war. As documented in the London Letters, the London Office was especially affected, given the conscription of all men (aged 18–41 years) who had been resident in Britain since August 1914. By the end of 1916, all male staff in the London Office had been conscripted and at some stage served, with the exception of the manager, Mr Charles Campion. (Remarkably, all 5 of his sons served at Gallipoli and then on the Western Front – and all survived the war.)

Manager Charles Campion (foreground with top hat) in front of the London Office with staff and Australian military personnel, RBA Archives PN-000293

A critical function of the London Office was to ensure that Australian military personnel could be paid while serving overseas. At the outset of the First World War, the Bank made savings bank facilities available to the Australian Expeditionary Force. These facilities allowed servicemen to draw part of their pay with the rest deposited into a savings account by the Pay Corps master, which they could access while overseas or their relatives could access in Australia. The Bank also made arrangements for servicemen to access their money where there weren’t existing Bank branches, including through the establishment of special branches in air force and naval facilities. In fact, by 1915 all warships were attached to agencies of the Bank so that money could be cabled to the paymasters on board. The London Letters include reports about these arrangements (which were significantly expanded in the Second World War, particularly with respect to warships).

In addition to banking arrangements for service personnel, the Bank was required to assume the role of banker to the government – its first step towards being a central bank – as it assisted the Commonwealth Government raise and manage loans from Britain in support of the war effort. The London Letters document these developments and include regular reports for head office on aspects of war finance.

More generally, the London Office was critical in ensuring that the Bank’s head office in Sydney was kept up to date with developments in Europe, and that the overseas borrowings and investments, which helped fund Australia’s involvement in the war were appropriately managed. As well as the London managers’ reports and observations, the London Letters contain correspondence with other institutions and economists in Britain and together they form a near real-time account of the war and the Bank’s contribution to it.

Governor Denison Miller visited London towards the end of the First World War, at a time of still considerable danger and entailing a lengthy voyage by sea. The London Letters document his visit to the London Office and other key financial institutions. They also contain briefings for senior staff about the design and implementation of post-war reparations.

The Great Depression of the 1930s

The Great Depression of the 1930s was another period of significant challenge for the Bank, which saw further development of its central banking functions – in particular its role as lender of last resort and its management of the nation’s gold and foreign exchange, with the latter being extensively covered in the London Letters.

The London Letters include regular reports that were designed to keep the Governor abreast of economic and financial issues in Britain and other major economies, and on Australian investments there. These Letters were of particular importance during the Great Depression, with the proximity of the London Office to sources of intelligence about economies in the northern hemisphere enabling informed and timely assessments. In addition, the Governor received regular reports on the production and prices of commodities relevant to Australia, with these capturing the major falls in the world prices of commodities that had such a dramatic impact on the value of Australia’s exports.

With management of sterling reserves and gold a central function of the London Office, the London Letters also give insights into the impact of the Australian pound being pegged to the pound sterling (something put in place in 1931). Being pegged to sterling was of consequence since, during the Great Depression, Britain operated under the Gold Standard (where the value of currency is directly linked to gold). Gold was convertible with sterling at a fixed rate that overvalued both sterling and the Australian pound, compounding the external imbalance that weighed on economic activity in Australia.

The fall in export earnings made it increasingly difficult for Australian businesses to repay existing loans and to secure new loans, particularly loans issued overseas, which had traditionally been an important source of funding. With most of Australia’s overseas borrowings being through London banks, the London Letters note the difficulties in accessing overseas loans. They shed light on the reduced lending activities of financial institutions more generally, and they document Commonwealth and state borrowings and balances in London.

The combination of large falls in Australia’s export earnings and lack of access to overseas borrowings were the immediate external causes of the severe economic contraction and historic increase in unemployment. They also generated a crisis through exhaustion of the international reserves in Australia’s banking system, which largely comprised gold and pound sterling (or London Funds). In addition to the reduced ability to pay for imports, the exhaustion of international reserves created the prospect of national insolvency, as interest payments could not be met on outstanding overseas loans and a large tranche of external debt (related to the First World War and 1920s infrastructure projects) was about to mature. The London Letters contain records about this crisis and the efforts to address it. They cover developments in the holdings, sale and transport of gold, which came under the management of the Bank during this time. They also cover the Mobilisation Agreement for London Funds (intended to enable the Bank to oversee Australia’s loan repayments to London banks). And they cover the unpegging of the Australian pound from sterling and the decision by Britain to abandon the Gold Standard.

Efforts to maintain national solvency included an invitation by the Australian Government for expert advice by Sir Otto Niemeyer of the Bank of England (who was a representative of Britain in the work of the League of Nations). The visit was encouraged by the Chair of the Bank’s Board, Sir Robert Gibson. Sir Otto visited to assess the feasibility of Australia deferring the repayment of the war debt it owed Britain. The London Letters contain details of the arrangements for his visit, references to Sir Otto’s recommendations and reactions to his advice – both economic and political.

Sir Otto Niemeyer (left) with the Chair of the Commonwealth Bank’s Board, Sir Robert Gibson (centre), and the Bank’s Governor Ernest Riddle (right), RBA Archives PN-002050

The magnitude of the Great Depression and the breadth of its consequences encouraged a new focus on economic policy. The London Letters include records relating to the British Empire Economic Conference (also known as the Ottawa Conference); it was held among British colonies and autonomous dominions of the Commonwealth in 1932 to discuss the Great Depression, and was attended by Governor Riddle and the Bank’s economic advisor, Leslie Melville. These discussions included an admission of the failure of the Gold Standard, an agreement for preferential tariffs for British Empire countries to foster closer economic relations among them, and an adoption of Keynesian ideas to tackle economic recovery. Melville returned to Australia from the Ottawa Conference via London (where it is known from other sources that Keynes invited him to attend one of his famous Monday night seminars in Cambridge and to a lunch with him and his wife).

In addition to the Ottawa Conference, the London Letters also include records about the World Economic Conference of 1933, which furthered efforts discussed at Ottawa to combat the Great Depression, revive international trade, and stabilise foreign exchange markets. Hosted in London and attended by representatives of 66 nations, it was opened by King George V, with Leslie Melville once again attending as an adviser to the Australian delegation, led by former prime minister Stanley Bruce. The London Letters contain reports of the conference, written by the Manager of the London office to Governor Riddle in Sydney, and also records about Melville’s London visit, even including details of the new economic books he ordered to be sent to the Bank’s head office. (In fact, identifying economic literature to be purchased for head office became a regular service of the London Office.)

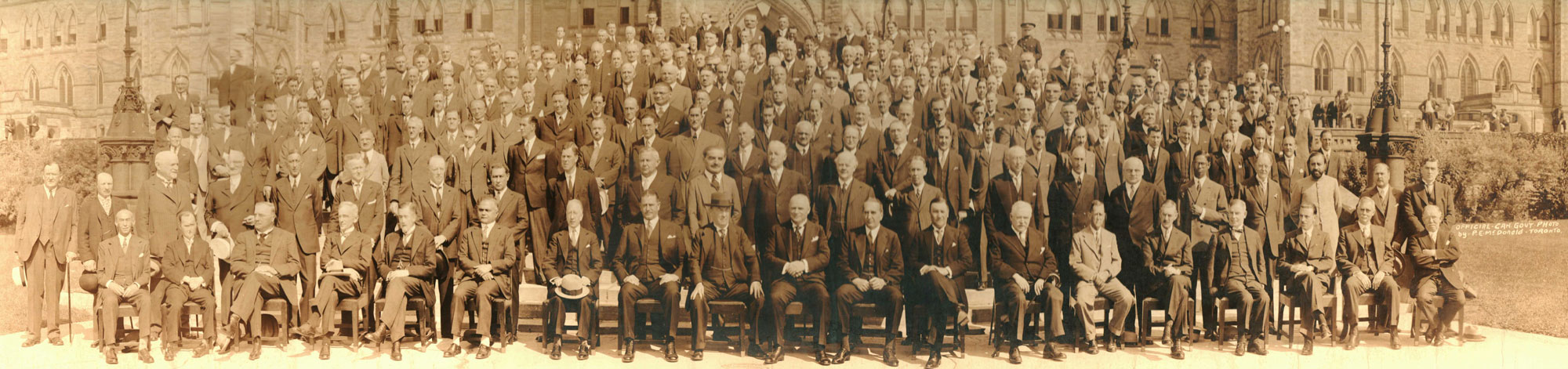

Participants of the Ottawa Conference in 1932, RBA Archives PN-001290

During the Depression years, the Manager of the London Office reported on the political tensions between countries, particularly those that were causing nervousness in financial and product markets, and risked wider economic consequences. (These reports are not confined to countries in Europe and extend to tensions between Japan and China.) Given the hardships endured by citizens during the Great Depression, the London Letters include observations of discontent among populations of European countries (in particular Germany) and opinions about the potential consequences of such discontent.

The Second World War

The Second World War necessitated a range of controls being given to the Bank indefinitely, significantly consolidating its central banking functions (in oversight of the banking system and foreign exchange control, with the latter remaining in place until the float of the Australian dollar in 1983). The war broke out at a time of falling London Funds (which were at their lowest level since the crisis of the early 1930s) and an urgent need to safeguard the nation’s international reserves, including non-sterling reserves. (Non-sterling reserves became important because the new type of warfare required greater imports of machinery and equipment from various allied countries to equip Australia’s military forces and develop the domestic production capabilities of a war-time economy.) When the war began, the Commonwealth Government approved the Bank having immediate control of all transactions in foreign exchange. As detailed in the London Letters, the London Office remained central to the management of London Funds.

The London Letters contain staff views on bombing raids and attacks by the German and Japanese forces, and on the British response. The impact of the hostilities on sea-trade routes and supply of goods had significant implications for the balance of payments and the level and composition of international reserves, with this noted in the Letters.

A particularly rich vein of economic intelligence and analysis in the London Letters is the correspondence of the Hungarian-British economist Thomas Balogh – a supporter of Keynes and competitor of Nicholas Kaldor for both economic and political influence. Balogh’s exceptional talent as an economist, his knowledge of the German economy and war industry, along with his personal networks, made him well placed to write economic reports for the Bank’s Board and senior officers. Engaged by the Bank in 1941, Balogh’s association with the Bank was kept secret and the distribution of his reports was tightly controlled. On several occasions his contract was nearly discontinued because of his radical views, abrasiveness and fierce criticism of the Bank of England. But while he had many detractors, other economists – including Leslie Melville, LF Giblin and HC Coombs – were stimulated by his observations and analysis (RBA 2013, p16). In particular, he influenced discussions about how to maximise Australia’s war effort without exacerbating inflation, while also providing insightful commentary about the war (sometimes with great poignancy, as Balogh was of Jewish heritage). The reports by Balogh are of particular value because detailed observations and assessments are made consistently in one voice from 1941 to 1964, when he became adviser to the Cabinet of British Prime Minister Harold Wilson and a senior government minister (sitting in the House of Lords).

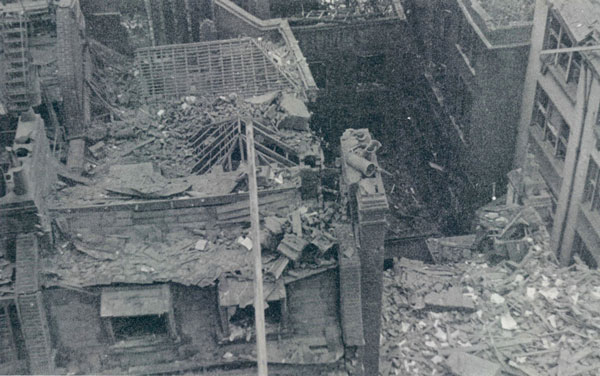

The London Office was itself operating in a war zone that was subject to bombing raids. Consequently, the London Letters contain information about its air raid precautions, for the protection of both staff and Bank records. They also include details of bombings that affected their operations directly (such as the bomb damage to London Office at Old Jewry and the evacuation of its Bonds and Stock Department to Cobham) along with details of staff who had been personally affected by air raids.

London Office, Old Jewry, rooftop after bomb damage in 1944, RBA Archives PN-004234

Closer to home, the London Letters contain correspondence regarding the bombing of the Port of Darwin, along with the closure of the Bank’s branch in Darwin and other private bank branches after the city was designated a military zone.

Concerns that mail could be lost or intercepted led to the London Letters being assigned additional categories of mail security that will be visible to users of the records. For example, Safe Hand Mail was for confidential information that had been reviewed by the Commonwealth Government and sent to or from London by air. During the flight, the mail bag remained in the custody of the pilot who had instructions to destroy its contents rather than let information fall into enemy hands. For less confidential correspondence, typed Airgraph Letters were photographed on microfilm to conserve space and weight and the file sent to and from London by air (while towards the end of the war, very lightweight Airgraph Letters were developed).

Bretton Woods

In 1944, with the outcome of the Second World War still far from certain, delegates from allied nations met at Bretton Woods, New Hampshire, to plan the international post-war monetary system. They sought to agree on a new economic order that would minimise the trade and foreign exchange restrictions that had previously impeded economic prosperity, and establish institutions to facilitate the new order (the International Monetary fund and World Bank). From this agreement also emerged a global system of pegged exchange rates, known as the Bretton Woods system, with the US dollar as the reserve currency to which other currencies would retain parity.

The London Letters contain records about Australia’s participation at the Bretton Woods conference, where Australia’s representatives included the Bank’s Leslie Melville. (The others were FH Wheeler of Treasury, Arthur Tange of the Department of External Affairs, and JB Brigden, advisor to the Australian Legion in Washington.) The Australian delegates are said to have caused ‘quite a commotion’ through their advocacy of full employment as a primary consideration for economic recovery while the United States – the lead nation – made removal of impediments to trade central to the Agreement that delegates were to sign (Cornish 2019).

The London Letters include some reports by Melville (with others associated with different record series in the archives). The majority of the records about Bretton Woods are Balogh’s comments about the issues debated at the conference, the subsequent agreements and the Bretton Woods Agreements Act that came from it. He expresses views about the relationship between Britain and the United States during the negotiations. His assessments are detailed and frank, and he often comments on events as they unfold. Balogh expressed support for the Australian position regarding the need for a full employment goal to promote economic recovery, rather than placing the main emphasis on removal of impediments to trade. His reports on the outcomes of Bretton Woods continue through to the 1950s, often for context, comparison, or as a broader discussion regarding economic policy in the post-war period.

On the Bretton Woods system of exchange rates, there are regular reports and commentary in the London Letters on the management of the peg of the Australian pound (and subsequently Australian dollar) to sterling. In particular, they provide details of the significant events of November 1967 – the only occasion in the post-war period when the Australian pound peg to sterling was changed, because Australia did not devalue with sterling against the US dollar and other currencies.

Exchange rate and commodity price shocks of the 1970s

The 1970s were a turbulent period for central banking. The post-war Bretton Woods system of pegged exchange rates came under pressure when large current account imbalances revealed a fundamental disequilibrium among major economies. The system collapsed in 1971 when the United States suspended convertibility of its dollar with gold. Since convertibility of the US dollar with gold underpinned the Bretton Woods system, its suspension and the associated loss of market confidence ultimately forced most major advanced economies to float their exchange rates. Australia maintained a pegged exchange rate (partly because its financial system was not yet mature) but replaced its traditional peg to sterling with one to the US dollar, in line with its growing trade links to the United States and the shift in gravity towards New York as a financial centre. These events and surrounding debates are documented in the London Letters. They cover observations about the Smithsonian Agreement that had attempted to salvage the Bretton Woods system, the pressures on major economies (notably Germany and subsequently the United Kingdom) to float their currencies, through to the under-preparedness of Australia for a departure from the Bretton Woods system. The London Letters also include discussions about the appropriate parity for pegging the Australian dollar to the US dollar.

Another prominent theme of the London Letters is shocks to commodity prices. Australia experienced a significant upswing in its terms of trade in the early 1970s buoyed by rising prices for its exports of rural commodities, minerals and metals. This was followed by a sharp terms of trade fall in the mid-1970s when, as a net importer of oil, Australia was affected by the OPEC oil embargo of October 1973 that led to a quadrupling of oil prices. The London Letters contain reports about these commodity price developments, the impact of the oil price shock from the perspective of the northern hemisphere, and discussions of commodity price movements for the management of Australia’s foreign exchange. Furthermore, the Letters include references to the shift to pegging the Australian dollar to a trade-weighted basket of currencies in an effort to help insulate the economy from swings in the terms of trade – the first step towards a flexible exchange rate regime.

The 1970s were a period of significant political developments and social change in Australia, with the London Letters containing observations on the Australian political landscape leading up to 1975 and the effects of developments in world markets on domestic economic activity, including the recession of 1974–1975. Of note in this period is the number of female Bank staff now representing the Bank at conferences and business trips overseas, including to the OPEC Conference in April 1974.

Supporting users of Unreserved

To assist users of Unreserved, the archivists have prepared 2 types of guides to the collection: Series Guides and Research Guides.

The Series Guides describe the properties of the series that have been released so that users are aware of the date range of the records they include, the entity or person considered to be their creator, the volume of records available, their medium and format, and the broad scope of topics they cover. Furthermore, the Series Guides contain a summary of the historical context of the series.

The Research Guides are designed to assist users to explore records about a topic that might be found in multiple series. They also direct users to related collections (for example, of digitised photographs and film) that complement the files and documents related to the research topic. The Research Guides reflect research interests of existing users of the Bank’s archives as well as revealing the potential use of series that, to date, have had little if any public exposure.

While Unreserved has been designed for ‘self-service’ by the public, and researchers in particular, it also enables users to lodge requests for information with the archivists, contact them directly to better understand the records and request to examine physical records under the supervision of the archivists in the Bank’s dedicated Research Room at its head office in Sydney. In this way, the personal assistance that has traditionally been provided by the Bank’s archivists remains and complements the independent research that the public can pursue using a digital archive.

Looking ahead

Major releases of digitised records are expected to occur twice-yearly, and be accompanied by corresponding Series and Research Guides. The next release is scheduled for September 2021 and is expected to include information about the activities of the Bank’s early governors and senior personnel, along with outputs of the Bank’s first department responsible for economic analysis and research.

As the Bank’s digitisation program proceeds, it increases access to the wealth of information housed in the Bank’s archives. For example, the digitised colonial banking records released with the launch of Unreserved provide a unique source of depositor-level data to assess depositor behaviour during the Depression of the 1890s and the Great Depression of the 1930s. They have been examined to obtain a better understanding of how depositors might behave in more contemporary periods of severe recession or financial instability. (See La Cava and Price (2021), ‘The Anatomy of a Banking Crisis: Household Depositors in the Australian Depressions’, in this issue of the Bulletin.) Publishing this type of research will raise awareness of the scope and potential uses of the Bank’s archival records to other researchers, in a range of disciplines, and increase the benefit of public access to them.

Unreserved provides a window for the public into the evolution of the nation’s central bank – its responsibilities, operations, analysis and decision-making. With the records spanning significant moments in history – including those that remain familiar to many citizens – it provides an insight into the central bank’s place in the broader life of the nation. And Unreserved is a vehicle for the public to access information unrelated to central banking but of which we are custodian through the circumstances of our own history. It is launched in the spirit of public access to information and the preservation of a national collection.

References

Commonwealth Bank of Australia (1947), Commonwealth Bank of Australia in the Second World War, John Sands, Sydney.

Cornish, S (2019), ‘Bretton Woods at seventy-five’, Inside Story, 30 June <http://insidestory.org.au/bretton-woods-at-seventy-five/>.

Cornish, S and W Coleman (2014), ‘Making a land fit for a gold standard: monetary policy in Australia 1920–1925’, CEH Discussion Papers 027, Centre for Economic History, Research School of Economics, Australian National University.

Cornish, S (1993), ‘Sir Leslie Melville: an Interview’, Economic Record, 6(4), pp 437–457.

Cornish, S and K Schuler (2019), ‘Australia’s Full-Employment Proposals at Bretton Woods: a Road Only Partly Taken’ in Naomi Lamoreaux and Ian Shapiro, eds, The Bretton Woods Agreements, Yale University Press, New Haven and London, pp 173–194.

Debelle G and M Plumb (2006), ‘The Evolution of Exchange Rate Policy and Capital Controls in Australia’, Asian Economic Papers, 5(2), pp 7–29.

Fitz-Gibbon, B and M Gizycki (2001), ‘History of Last-Resort Lending and Other Support for Troubled Financial Institutions in Australia’, RBA Research Discussion Paper No 2001-07, <https://www.rba.gov.au/publications/rdp/2001/2001-07/>.

Giblin, LF (1951), Growth of a Central Bank: The Development of the Commonwealth Bank of Australia, 1924–1945, Melbourne University Press.

La Cava, G and F Price (2021), ‘The Anatomy of a Banking Crisis: Household Depositors in the Australian Depressions’, RBA Bulletin, March. Available at <https://www.rba.gov.au/publications/bulletin/2021/mar/the-anatomy-of-a-banking-crisis-household-depositors-in-the-australian-depressions.html>

Morris J (2007), The Life and Times of Thomas Balogh: A Macaw Among Mandarins, Sussex Academic Press, Brighton.

RBA (2013), ‘In Search of Balogh’, Currency, September, p 15.

Schedvin, B (1970), Australia and the Great Depression, Sydney University Press, Sydney.

Schedvin, B (1992), In Reserve: Central Banking in Australia, 1946–75, Allen & Unwin, St Leonards.

Source: Reserve Bank of Australia [2021]